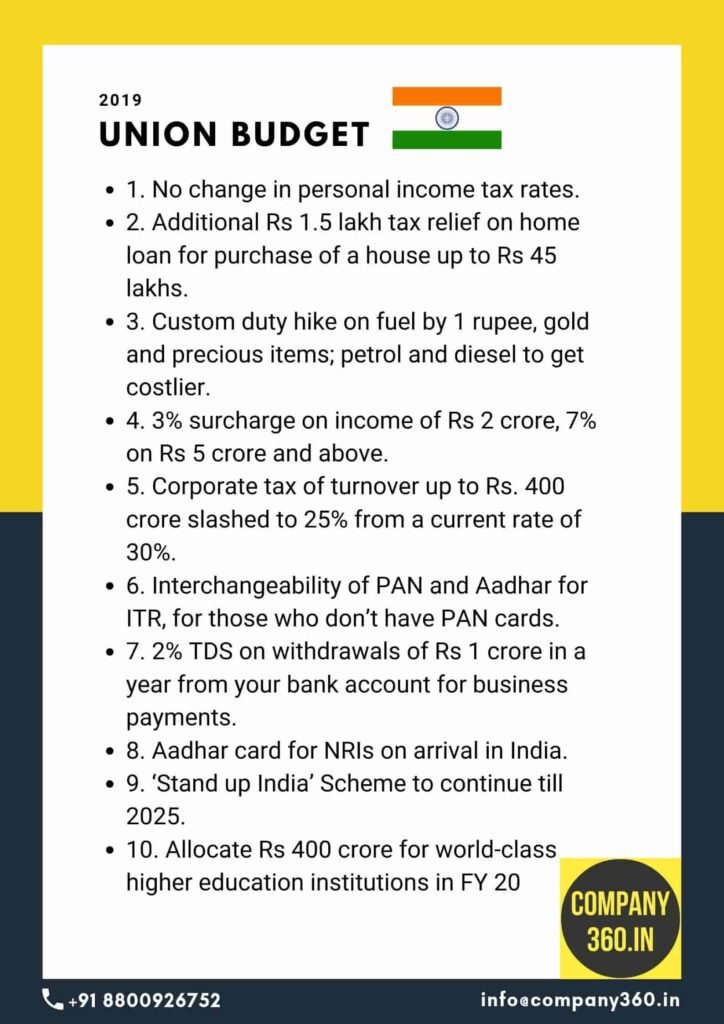

Key Announcements for Budget 2019

- No change in personal income tax rates.

- Additional Rs 1.5 lakh tax relief on home loan for purchase of a house up to Rs 45 lakhs.

- Custom duty hike on fuel by 1 rupee, gold and precious items; petrol and diesel to get costlier.

- 3% surcharge on income of Rs 2 crore, 7% on Rs 5 crore and above.

- Corporate tax of turnover up to Rs. 400 crore slashed to 25% from a current rate of 30%.

- Interchangeability of PAN and Aadhar for ITR, for those who don’t have PAN cards.

- 2% TDS on withdrawals of Rs 1 crore in a year from your bank account for business payments.

- Aadhar card for NRIs on arrival in India.

- ‘Stand up India’ Scheme to continue till 2025.

- Allocate Rs 400 crore for world-class higher education institutions in FY 20

- Fiscal Deficit Target revised to 3.3% of the GDP from 3.4% earlier

- Proposition to the SEBI that promoter holding limit be brought down from 75% to 65%

- A one-time government guarantee for the purchase of high-rated pooled assets of financially sound non-bank finance companies (NBFCs) up to INR 1trn

- Increase in custom duties on gold & precious metals, and additional cess on petrol and diesel

- Change in Housing Finance Companies regulator to RBI.

- Surcharge on 2 Individual income tax categories – Taxable income of between INR 2-5 cr at 3% and INR 5 cr & above at 7%. Now the highest tax rate in India is 42%